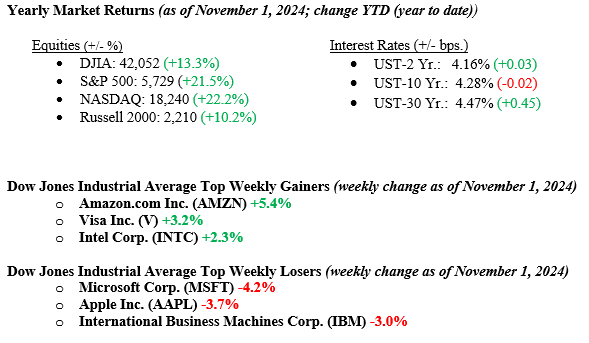

Last week, the stock market faced a modest decline, with major indices ending lower. The Dow Jones Industrial Average slipped by 0.1%, while the S&P 500 fell by 1.4% and the NASDAQ dropped by 1.5%. This retreat coincided with a week filled with earnings announcements and key economic data. For the third quarter, S&P 500 companies are expected to show approximately 5% growth in earnings, slightly better than anticipated at the beginning of earnings season. However, cautious outlooks from “Magnificent Seven” tech companies like Microsoft and Apple added to the market’s fluctuations. The October jobs report revealed disappointing growth, with just 12,000 new jobs created, with the shortfall attributed primarily to labor strikes at Boeing and the impact of two recent hurricanes. Despite these temporary setbacks, the broader economic outlook remains optimistic. The yield on the 10-year note ended the week at 4.28%. Concerns about inflation and the U.S. fiscal situation, including growing deficits, contribute to upward pressure on long-term yields.

U.S. & Global Economy

Last week’s economic data releases presented a confusing view of the U.S. economy. It was reported that third-quarter GDP growth increased at a rate of 2.8%. This growth rate slightly modifies from the second quarter’s 3.0% expansion but still indicates robust economic activity. Personal Consumption Expenditure (PCE) inflation figures matched forecasts, with core and headline PCE falling below 3% year-over-year. However, the October jobs report showed disappointing growth, adding only 12,000 jobs impacted by labor strikes and hurricanes. The unemployment rate remained steady, and hourly earnings rose by 0.4%, slightly surpassing the 0.3% estimate, indicating a resilient labor market. The ISM Manufacturing PMI indicated continued contraction at 46.5%, below expectations, marking the seventh month of decline. On a brighter note, U.S. consumer confidence surged in October to the highest level in nine months. These mixed signals suggest that while the economy continues to grow, it faces challenges, with moderating inflation and a strong labor market despite sector-specific difficulties.

Policy and Politics

Over the past week, geopolitical tensions have escalated markedly, particularly in the Middle East and Eastern Europe. Israel has ramped up its military operations against Hezbollah in Lebanon, leading to civilian casualties, while Hezbollah has retaliated with attacks on Israel. The situation in Gaza remains dire, with ongoing Israeli strikes exacerbating an already critical humanitarian crisis. In Eastern Europe, Russia has reported capturing more settlements in the Donetsk region as part of a renewed offensive in Ukraine. In a related development, South Korea has indicated a potential willingness to increase its support for Ukraine, possibly including military aid, a possible response to recent North Korean troop movements to support Russia. This situation could introduce a new dynamic to the conflict, involving both Koreas indirectly. Meanwhile, diplomatic efforts are ongoing, with an Iranian official set to meet with Saudi leaders, while U.S.-Israel relations appear to be experiencing some strain.

This week’s presidential election carries significant weight, with recent polls indicating a tight race that could swing in favor of either candidate, highlighting the importance of voter turnout and critical swing states.

Economic Numbers to Watch This Week

- U.S. Factory Orders for September 2024, prior level 0.2%.

- U.S. ISM Services for October 2024, prior level 54.9%

- U.S. Initial Claim for Unemployment for the week of November 2, 2024, prior level 216,000

- Target Fed Funds Rate, current level 5.00%

- U.S. Consumer Credit Outstanding for September 2024, prior level $8.929B

- U.S. Index of Consumer Sentiment for November 2024, prior level 70.5

The standout event this week will be Tuesday’s Presidential Election, which could lead to short-term volatility as uncertainty looms over the economic policies of the winner. Additionally, the Federal Reserve’s meeting on November 6-7 will be watched closely, with a widely anticipated 25 basis point rate cut expected. Investors will also monitor updates on consumer sentiment from the University of Michigan, along with the ISM Services PMI, Factory Orders, and Consumer Credit data. Furthermore, 103 S&P 500 companies are set to report their third-quarter results in the coming week. We feel strongly about reminding investors and readers that elections have little impact on markets over the long term, and the strength of the U.S. economy will be more impactful to markets. The U.S. economy remains healthy, with banks in good shape, consumers continuing to spend, and unemployment at near-record-low levels. If you have any questions or need further insights, don’t hesitate to contact your advisor at Valley National Financial Advisors.