by William Henderson, Vice President / Head of Investments

Markets ended mixed last week with the broader indices posting slight gains while the tech-heavy NASDAQ posted a loss. For the week that ended March 5, 2021, the Dow Jones Industrial Average returned +1.8% and the S&P 500 Index gained +0.8%, while the NASDAQ fell by -2.1%. Year-to-date, each index remains just in positive territory. Year-to-date, the Dow Jones Industrial Average has returned +3.3%, the S&P 500 Index +2.6% and the NASDAQ +0.4%. These returns are indicative of a strong recovery as growth stocks, which are best represented by the NASDAQ, initially lead the market out of a recession; and value stocks, represented more closely by the Dow Jones Industrial Average, tend to accelerate once the recovery is well under way.

Treasury bond yields continued to rise last week as the 10-year U.S. Treasury Note moved higher in yield by six basis points to 1.60%. Improving economic data and the imminent passing of the $1.9 trillion stimulus program both contributed to the sell-off in Treasuries. Last week saw a sharp reversal of equities on Friday as the US Bureau of Labor Statistics released a strong jobs number on Thursday. The domestic economy added 379,000 jobs in February, exceeding Bloomberg-surveyed economists’ forecasts for a 200,000 gain. The strong rebound in jobs, even before the economy fully reopens, is showing the full depth and breadth of the economy’s V-recovery. Further, Cornerstone Macro’s economist is predicting job gains in 2021 to average 500k per month and for Real GDP to approach 8-10% this year.

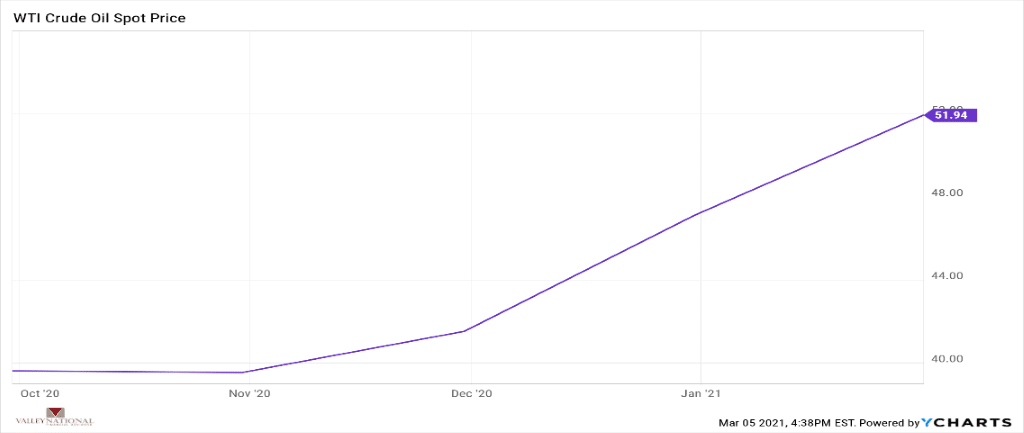

Inflations remains benign even in the face of higher oil prices. The spot price of WTI (West Texas Intermediate Crude) reached $52/barrel last week, a six-month high. This is what happens when you turn off or shrink the U.S. oil production spigot (think Keystone XL Pipeline, fracking and limited further drilling on federal lands.)

Conversely, solar and wind projects continue to set a rapid pace as the U.S. Energy market slowly but deliberately converts to renewable sources of energy from fossil fuels. Cornerstone Macro expects combined energy output from wind and solar to move from 12% in 2020 to 30% in 2030.

It is important to remember that a strong economy is always more important than oil prices and the fear of rising interest rates. Fed policy of near zero on short-term rates coupled with continued fiscal stimulus assistance are aiding the strong economic recovery we are seeing in 2021. The strong jobs number we saw last week is just the beginning. As the COVID-19 vaccination reaches more and more people, the travel and leisure sector of the economy is expected to bounce back as consumers are finally offered the opportunity to spend their squirreled away savings.