by William Henderson, Vice President / Head of Investments

The equity market continued its slide downward last week with poor returns across all three major indexes: albeit modest negative returns. Inflation continues to be the word of the year with a release last week of December 2021 CPI (Consumer Price Index) topping 7% for the month compared with 2020, which arguably was exactly what was predicted by economists. The Dow Jones Industrial Average fell by –0.9%, the S&P 500 Index lost –0.3%, and the NASDAQ also fell by -0.3%. Last week’s returns give us two weeks of negative returns meaning obviously poor year-to-date figures. Year-to-date, the Dow Jones Industrial Average is down -1.1%, the S&P 500 Index down -2.1% and the NASDAQ down by -4.8%. Bond yields moved higher last week, reacting to the inflation news and an overall sentiment that the Fed will raise interest sooner and faster than originally predicted. The 10-year U.S Treasury bond rose five basis points to close the week at 1.81%.

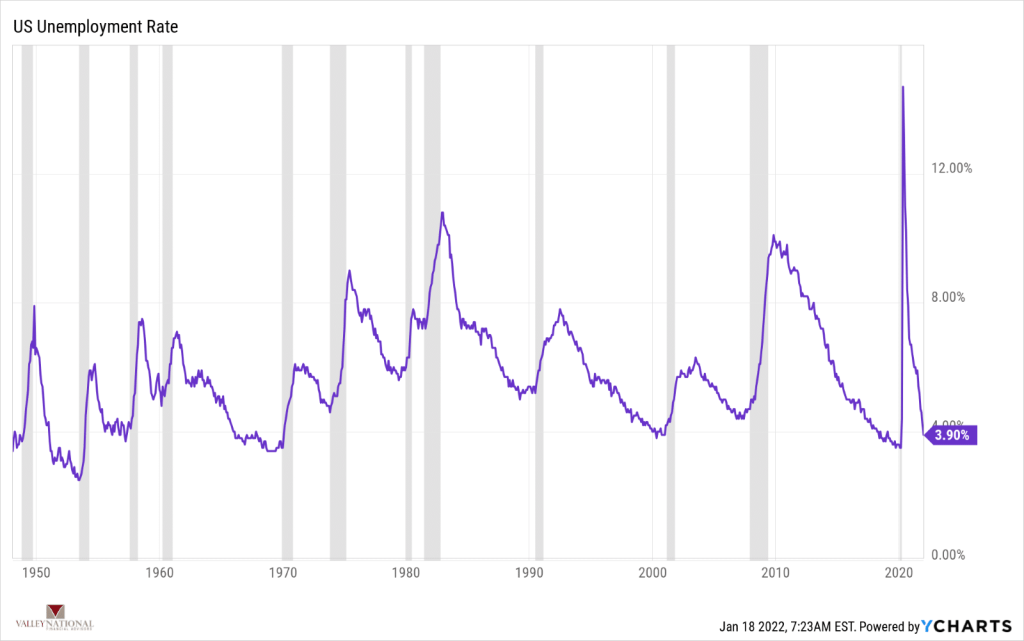

While the inflation reports seem high and are impacting all markets, we must remember that the Fed wanted inflation, which is part of its dual mandate of “price stability and maximum sustainable employment.” The Federal Reserve’s FOMC (Federal Open Market Committee) sets interest rates (monetary policy) at appropriate levels to achieve the dual mandate. We clearly have inflation and CPI releases surprised to the upside for most of 2021, but the November and December CPI figures were right in line with expectations. Further, employment numbers continue to be strong, and the current unemployment rate is 3.9%, almost near pre-pandemic levels. (See the chart below from YCharts and Valley National Financial Advisors – shaded sections = recessions).

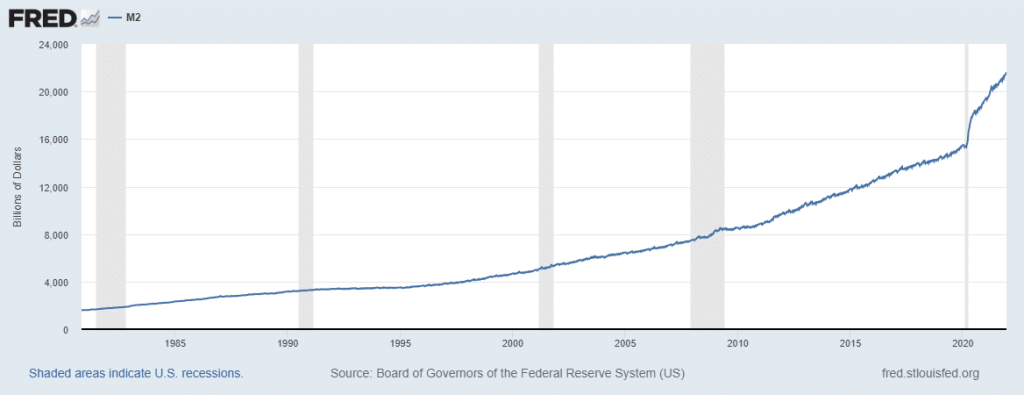

With inflation running well above the Fed’s 2.5% target and employment nearing sustaining levels, higher rates are clearly coming, and everyone knows this already. Fed Chairman Jay Powell has been very transparent with his plan for the economy and rates: tapering bond purchases, removing quantitative easing and raising interest rates. Fed Fund Futures markets are currently pricing in 4 25 basis point rate hikes in 2022, for a final target of 1.00-1.25% on the Funds Rate. Thus far in 2022, markets are reacting negatively to this, especially growth stocks which rely on low interest rates for borrowing and expansion. Last week, we showed a chart where markets rallied even during periods of rising interest rates. Further, modestly higher interest rates, both short-term and long-term, will still allow for continued economic expansion and will in no way be restrictive to growth. The shift in Fed policy certainly points to their concern about inflation but also underlies the strength of the labor market and the economic expansion. Lastly, higher interest rates, especially savings rates, will be a net positive for Americans with bank accounts and money market funds which are currently paying nothing to 0.01%. Since the onset of the pandemic, due to significant decreased spending, stimulus funds and increased savings, M2, the total supply of retail savings deposits and money market funds, has skyrocketed and as of December 2021 stood at $21.6 trillion. (See chart below from Federal Reserve Bank of St. Louis).

Reasonably higher savings rates on these deposits will be beneficial to savers and also give consumers more money to save, invest or spend – all of which are good for an expanding economy. This week will bring the start of earnings season and Wall Street analysts are predicting increases in net income and EPS but also predicting that EPS will be impacted by higher labor costs and actual labor shortages and increases in raw material costs. There’s been a lot of talk about a rotation from growth stocks to value stocks and certainly earnings season will exacerbate that trade one way or the other. Recall, January 2021, when Wall Street strategists predicting the same rotation trade only to see growth pick up steam after the first quarter. The Fed’s “hawkish” pivot to higher rates, strong inflation and slowing earnings growth are more than offset by a near-historic low unemployment levels, massive savings accounts piled up by the consumer and healthy pent-up demand for goods and services. A well-balanced portfolio and a long-term outlook better portend a successful investor and that is our mantra at Valley National Financial Advisors.