by William Henderson, Chief Investment Officer

In an oddly quiet end to a volatile week in the markets where we saw a 1,000-point swing in the Dow Jones Industrial Average in one day, each major market index closed the week in positive territory or up slightly. The Dow Jones Industrial Average rose +1.3%, the S&P 500 Index gained +0.8% and the NASDAQ was unchanged. Year-to-date, the returns tell a different story as the severe volatility has impacted each major index, especially the technology-heavy NASDAQ. Year-to-date, the Dow Jones Industrial Average is down –4.4%, the S&P 500 Index is down –6.9% and the NASDAQ is down by –12.0%. Even bonds, which investors flock to in times of great volatility and fear, moved lower in price as a result, and the 10-Year U.S Treasury bond rose by three basis points to close the week at 1.78%.

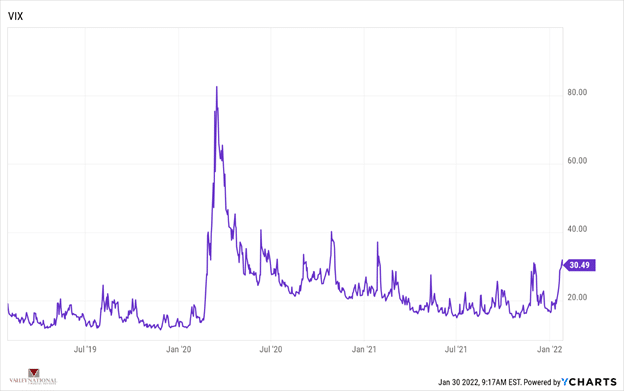

As mentioned, volatility in the markets has spiked, unlike 2021 where volatility was quiet and subdued. (See the chart below of the VIX (Volatility Index) from YCharts and Valley National Financial Advisors.) The VIX, the Chicago Board of Options Exchange Index, is designed to reflect investors’ consensus view of the future expected stock market volatility.

While the VIX has spiked in recent moves, it is nowhere near the fear levels we saw in March 2020 as the pandemic settled onto Wall Street. Earlier in the week, all the market noise was about the Fed and Jay Powell’s press conference following the end of the two-day FOMC (Federal Open Market Committee) meeting on Wednesday. Once the meeting was over, Chairman Powell had assuaged concerns that the Fed would be reckless in adjusting monetary policy. Further, Powell acknowledged that recent indicators of economic activity and employment continue to strengthen but remain impacted by the recent sharp rise in COVID-19 cases. Further, while Powell pointed to inflation running well above his 2% target, supply and demand imbalances related to the pandemic remain in place and are responsible for inflationary pressures. Lastly, the minutes of the FOMC meeting repeated their previous statement, “that it will continue to reduce the pace of bond purchases and expects it will be soon appropriate to raise the target range for the federal funds rate.”

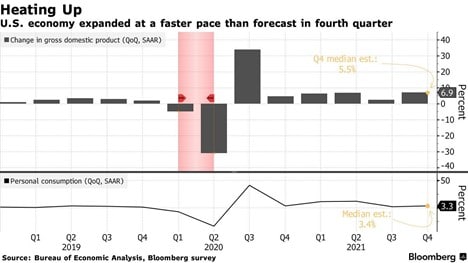

As we mentioned last week, equity markets have historically performed well through interest rate tightening cycles, and we pointed out to a Bloomberg article stating that the S&P 500 Index had averaged +9% annually during the previous 12 tightening cycles going all the way back to 1950. Our view is that while we will have greater volatility (see VIX above) we still expect markets to be positive in the year ahead. While last week focused mostly on the Fed and the release of the FOMC meeting minutes, an important economic report went almost unnoticed. U.S. 4th Quarter GDP was released at +6.9%, well above Wall Street economists’ expectations of +5.5% and full year 2021 GDP came in at +5.7%, also above consensus estimates. (See the chart below from the Bureau of Economic Analysis and Bloomberg).

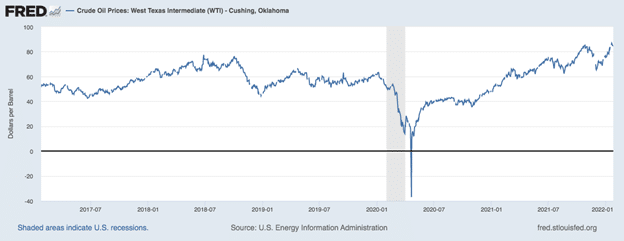

The current economic expansion, which started mid-third-quarter 2020, while solidly underway, still has plenty of pent-up steam left. In fact, FactSet has corporate earnings growth topping 9% this year; and the economic expansion continuing well into 2023. Again, we agree here as we have pointed out the relative financial strength and health of the banks, corporations, and the consumer; each of which individually and jointly fuels the economy. There are a few things that we are keeping our eyes on for a potential shock to the markets including: tensions between Russia and Ukraine, continued outbreaks of new COVID-19 variants and even oil prices, which continue to grind higher, hitting $84.48/bbl. last week (see chart below from the Federal Reserve Bank of St. Louis).

Oil prices are now higher than pre-pandemic levels when the U.S. was considered by many to be oil independent. Oil is critical for most economic activity from plastics to home heating oil to gasoline; so, increases in prices will have immediate and lasting effects on inflation.

It is easier to get swooped up with the noise of the markets and Wall Street than to stay focused on what is in front of us: economic expansion, attentive monetary policy, and a healthy and wealthy consumer.