by William Henderson, Chief Investment Officer

While year-to-date returns remain in the negative column for all three major market indexes, last week produced a positive week for patient and persistent investors. The Dow Jones Industrial Average rose +1.1%, the S&P 500 Index gained +1.6% and the NASDAQ, as the week’s bigger winner, gained +2.4%. As stated, year-to-date returns remain negative with the Dow Jones Industrial Average down –3.4%, the S&P 500 Index down –5.5% and the NASDAQ down -9.8%. Fixed income, as in Treasury Bonds, which normally provide investors relief when markets are selling off, have fared no better year-to-date. Last week, the yield on the 10-year U.S Treasury bond rose by 15 basis points to close the week at 1.93%.

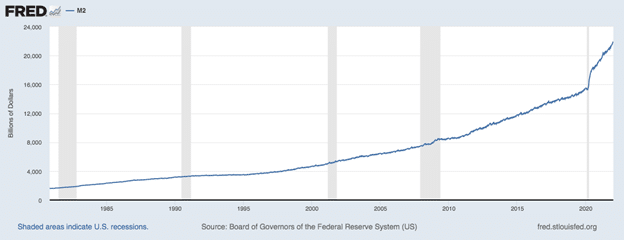

Our thesis each week is one centered around long-term investing that focuses on macro themes and avoids the noise presented by headline grabbing news sound bites and other hyperbolic tape bombs. We have focused on the solid fundamentals that backstop the U.S. economy including well capitalized and healthy banks, profitable and growing corporations and consumers that are sitting on $21.8 trillion (about $67,000 per person in the US) of cash with few “open” venues to spend their money. (See chart of M2 by the Federal Reserve Bank of St. Louis. M2 consists of savings deposits, balances in retail money market funds and small-denomination time deposits.)

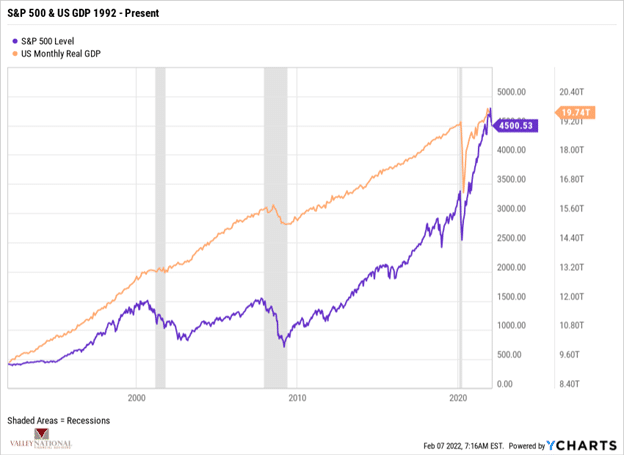

These fundamental strengths in the U.S. economy have led to strong year over year GDP growth, near record low unemployment and near record levels on major stock market indexes. We point this out to remind investors of the importance of the relationship between a growing economy and a rising stock market. See the chart below from Valley National Financial Advisors and YCharts, which shows the S&P 500 Index with U.S. Total GDP from 1992 to the present.

There is a clear correlation between GDP growth and the stock market, especially over extended periods of time. This commitment to long-term investment has rewarded the patient investor who sees the impact of macro themes on the markets. We have stated that pull-backs and market corrections happen all the time, and notably during bull markets. These occurrences are common and normal in functioning markets. So, while we have seen weak year-to-date returns on markets (-5.5% YTD on the S&P 500 Index) recall that the S&P 500 Index returned +26.9%, in 2021 and +16.3% in 2020 and has averaged +10.5% annually since its inception in 1926 (Investopedia). Long-term results are what matters to investors, not short-term returns, or short-term thinking.

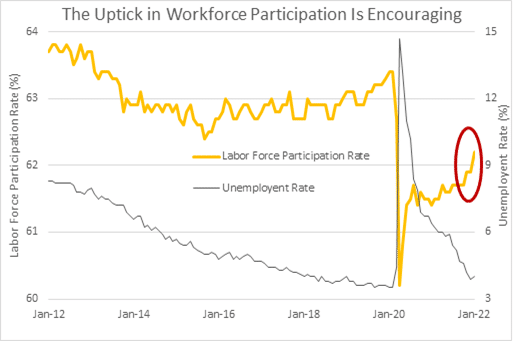

Further, last Friday’s release of the latest monthly employment report sent another wave of good news. In January, 467,000 new jobs were created, which far exceeded Wall Street economists’ expectations of +125,000. The massive increase in new jobs was surprising especially given the headwinds that the omicron variant created. Particularly encouraging was the relative strength of job growth in the leisure and hospitality sectors which remain below pre-pandemic levels. Lastly, there was a sharp jump in the labor participation rate which moved to a post-pandemic high (see the chart below from FactSet and Edward Jones).

The labor force participation rate indicates the percentage of all people of working age who are employed or are actively seeking work. When factored in with the unemployment rate (currently at 4%), the participation rate offers perspective into the state of the economy, which we believe continues to exhibit strength and solid potential for greater growth well into 2023.

Certainly, last week’s jobs report puts the Federal Reserve in a quandary about interest rates and the speed and size of pending rate hikes. Everyone knows rate hikes by the Fed are coming in 2022 and into 2023. We pointed out last week that the stock market commonly moves higher, even during rate hikes and especially as rate hikes are known and already factored into most investors’ plans for 2022. We remain steadfast in our positive long-term outlook for the economy and the markets. Committed investors should do the same.