by William Henderson, Chief Investment Officer

Gangbuster numbers in retail sales and existing home sales failed to move markets higher as the continued unrest in the Russia / Ukraine put a damper on the markets. President Biden spoke towards the end of the week and said, “he believed an invasion by Russia into Ukraine was imminent.” That is all the fragile markets needed to chalk up another losing week across all three major stock market indexes. The Dow Jones Industrial Average fell -1.9%, the S&P 500 Index lost -1.6% and the NASDAQ lost -1.8%. Weekly returns added to a poor year so far in 2022, and all three major indexes are sitting on negative year-to-date numbers. Year-to-date, the Dow Jones Industrial Average is down -6.0%, the S&P 500 Index is down -8.6% and the NASDAQ, which naturally tilts to growth stocks and is much more sensitive to interest rates moves, is down -13.3%. Fortunately, as we have said over and over, when risk assets sell off, investors flee to the safety of bonds. Treasury rates moved lower across the curve 1-5 basis points: while the 10-Year U.S. Treasury Bond remained unchanged at 1.92%.

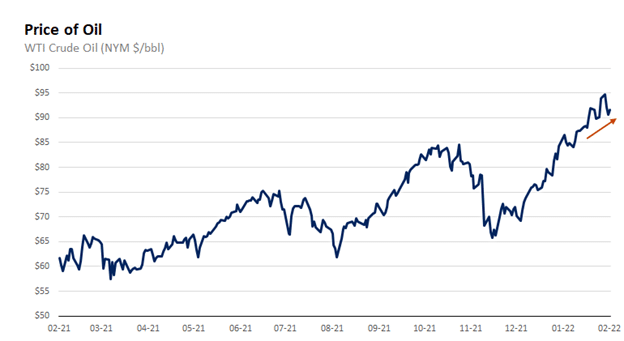

The geopolitical situation remains fragile, but markets have typically tended to look past lesser geopolitical crises, instead focusing on where there may be pockets of economic impact. For example, Russia remains one of the largest oil producers especially in the European region where it also supplies up to 40% of natural gas to the region. We’ve certainly seen an impact on oil as the price of a barrel of West Texas Intermediate (WTI) has increased over the past several months. See the chart below from FactSet of the price of WTI since February of 2021.

Oil is a critical component of many things well beyond simple heating and gasoline and the impact of higher oil prices are felt everywhere. As recent as 2019, the United States was completely oil independent producing enough energy to supply our own needs. The current administration killed the Keystone XL and banned new fracking on day 1 of taking office.

Beyond the Russia / Ukraine situation there were pockets of good news, as mentioned above. Sales of existing homes rose +6.7% in January from the prior month to a seasonally adjusted rate of 5.5 million units, according to the National Association of Realtors. The housing market remains extremely competitive even in the face of rising mortgage rates in recent months. Additionally, U.S. retail sales for the month of January came in well ahead of expectations at +3.8% vs estimates of +1.9%, despite continued noise around the omicron variant. Retail sales increased in online sales, furniture and autos. As mentioned last week, the consumer remains well positioned to fuel the great “second reopening” of the economy especially as we move into spring and summer travel season.

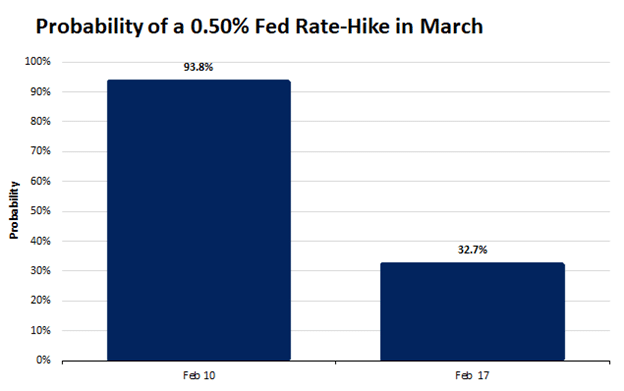

A final piece of economic news released last week was the Fed minutes from the January FOMC meeting. The minutes provided some comfort to the markets as they did not seem overly hawkish (higher rates) and contained no material surprises. Economists had been predicting a +0.50% rate hike at the March 15-16 meeting; but the minutes revealed a Fed willing to raise rates at a gradual and measured pace. Almost immediately, markets adjusted the probability of a +0.50% rate to less than 33% from 94% (see chart below from FactSet showing the change in rate expectations from February 10 to February 17).

In our opinion, this is good news for the markets. Inflation is running at a level that warrants higher interest rates but interest rates also fuel the economy so it can be a slippery slope for the Fed – raise rates to combat inflation but don’t kill the economic growth we are seeing. We believe a series of +0.25% rate hikes in a gradual, measured, and transparent manner is the right recipe for the Fed to quell inflation but continue to allow economic expansion. We further expect a gradual flattening of the yield curve (curve showing interest rates over time from short-term Treasuries to long-term bonds) as short rates rise but pressure on longer-term bonds continues due to pension funds, foreign buyers and investors seeking bonds as a risk management tool in their portfolios.

This week we get a few more economic indicators including Revised 4th Quarter GDP (prior +6.9%) and U.S. Initial Claims for Unemployment. It is a holiday-shortened week and headlines will be dominated by the situation with Russia / Ukraine, and less so by the sound foundation underlying the growing U.S. economy.