by William Henderson, Chief Investment Officer

Market volatility prevailed last week as the Russia / Ukraine “crisis” spiraled into a full-scale invasion and war between the two countries. On a continent that has been free of international aggressions of this sort since WWII, Russia acted unilaterally and invaded Ukraine. International reaction was mostly unified with quick condemnation from all countries except China, who remained silent. Markets ended the week on a mixed note, but wild price swings of 500 and 1000 points (on the Dow Jones Industrial Average) were common all week. The Dow Jones Industrial Average fell -0.7%, the S&P 500 Index gained +0.1% and the NASDAQ lost -0.2%. Year-to-date returns remain well in negative territory for all three major indexes. Year-to-date, the Dow Jones Industrial Average is down -6.0%, the S&P 500 Index is down -7.8% and the NASDAQ is down -12.4%. Even bonds were not spared last week in the modest sell-off as the yield on the 10-Year U.S. Treasury rose five basis points week-over-week to end at 1.97%.

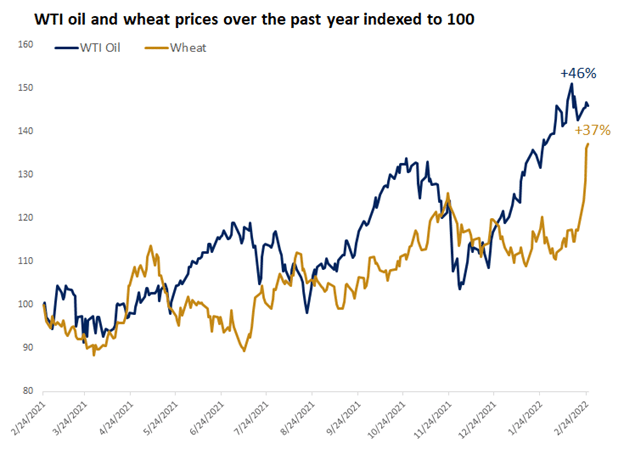

The Russian invasion has spiked market volatility, increased uncertainty around the pace of the global recovery from the pandemic and thankfully brought unilateral financial sanctions to Russia. Volatility results simply from the uncertainty surrounding the duration of the Russia / Ukraine war and the impacts it is having on commodity prices; as Russia is a significant producer of several major global commodities such as oil, wheat, and palladium (a critical rare earth used in catalytic converters). See the chart below from FactSet showing the recent spikes in prices of oil and wheat.

Thankfully, the reaction from the global community to the Russian invasion has been dramatic and financial sanctions such as limiting access to SWIFT banking channels and freezing of $630 billion of foreign reserves have already had an impact. Russia has closed its stock market, and the Russian Central Bank raised short-term rates from 9.5% to 20% to defend the tumbling Ruble. Of course, the reaction by the Russian people was a run on banks and ATMs in a last dash effort to get hard currency before an expected crash. Beyond financial sanctions and hardship on Russians themselves the international community has been swift in condemning Vladmir Putin personally and supporting Ukraine as much as possible. Given Ukraine is not a NATO country but borders several including Poland and Romania actual military support will be precarious and certainly measured baring a full-scale global conflict.

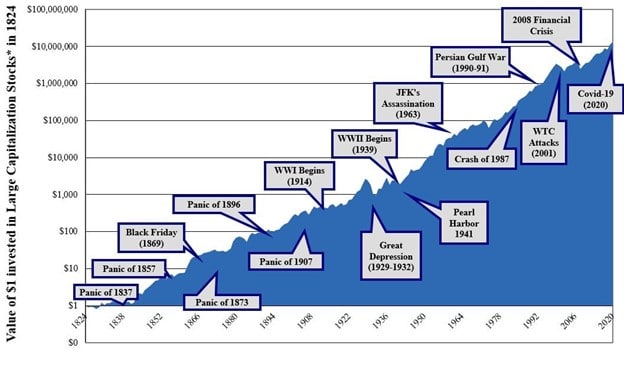

As mentioned, fear, uncertainty and volatility are never associated with good times in markets – in fact quite the opposite. However, historically, markets look past geopolitical events and move higher over extended periods of time; and that alone should be an investors’ focus. (See the chart below from Haverford Trust & Ibbottson. Associates showing major geopolitical events and the increase in $1 invested in Large Cap Equities).

While the underlying strength in the U.S. economy and thereby the markets exist, the current global uncertainty will prevail and grab all headlines. Higher commodity prices, specifically oil, have the propensity to impact the recovery and ongoing growth in the economy. Whether sanctions will prevail, and Russia retreats or U.S. policy makers impact markets by releasing strategic petroleum reserves, opening the Keystone XL pipeline or allow fracking again, we shall have to see. Typically, sell-offs in markets are short-lived and offer buying opportunities for longer-term investors. This week Fed Chairman Jay Powell reports to Congress and we may hear comments around the pace of rate hikes and balance sheet reduction in 2022. That story is significantly more important than what we are hearing from our national news media. Lastly, on Friday we will get another reading on U.S. employment conditions as the February jobs data is released.