by William Henderson, Chief Investment Officer

In much the same way we have seen violent selloffs precipitated by a risk-off trade, last week we saw a massive rally in equities and a related risk-on trade across all equity market sectors. The major market indexes posted their largest weekly gains since November 2020. The Dow Jones Industrial Average rose +5.5%, the S&P 500 Index rose +6.2% and the NASDAQ jumped higher by +8.2%. We have often spoken about the pitfalls of market timing and risks of missing the “big-move” days, well last week was a big-move week that rewarded investors that stayed the course and remained committed to their long-term investment plan. Year-to-date returns, while still in negative territory for the year, gained back a lot of their losses thus far in 2022. Year-to-date, the Dow Jones Industrial Average is down -3.9%, the S&P 500 Index is down -6.1% and the NASDAQ, gaining back over half of its year-to-date loss is now down -11.1% in 2022.

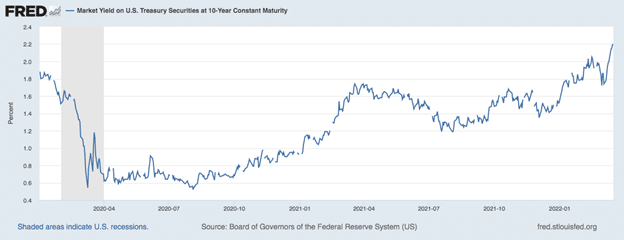

In potentially the least anticipated move of the year, the FOMC (Federal Open Market Committee) raised interest rates by a quarter of a point for the first time since 2018. Further, Fed Chair, Jay Powell, projected a clear path for 2022 with as many as six additional rate hikes bringing short-term rates to 1.75-2.00% by year-end 2022. Amid this news and continued high inflation readings, prices of government bonds fell, sending yields on U.S. Treasury Bonds higher for the second week in a row. The yield on the benchmark 10-Year U.S. Treasury Bond rose to 2.14% on Friday – the highest level in three years and up sharply from 1.73% just two weeks ago when the Ukraine / Russia war forced a temporary flight to quality amid major global geopolitical uncertainty. (See the chart below from the Federal Reserve Bank of St. Louis showing the 10-Year U.S. Treasury over the past three years.)

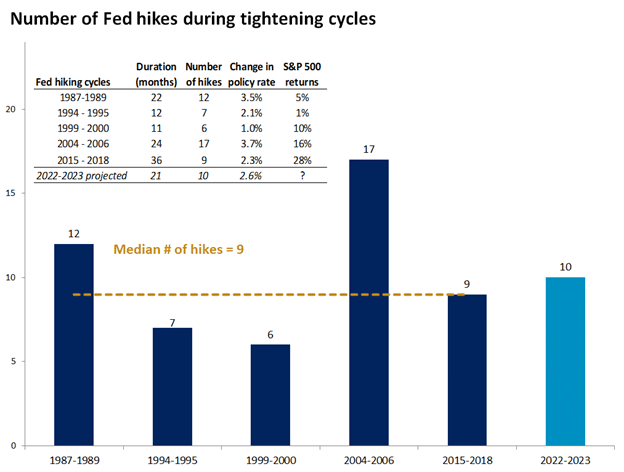

Despite the continued geopolitical uncertainty, inflation in the U.S. is clearly the dominant story and the absolute focus of the Fed. Chairman Powell is intent on raising rates this year to combat the strongest inflation data in 40 years. Price pressures exist on many fronts beyond those impacted by the pandemic and the resultant supply-chain crunch. Higher prices are being seen in autos, food, housing, rents, and many critical commodities such as oil and nickel, which are further pressured due to economic sanctions on Russia. During Powell’s press conference, after the FOMC meeting, he mentioned that Fed policymakers are now projecting inflation (as measured by core Personal Consumption Expenditure or PCE) to reach 4.1%, up from their previous projection of 2.7%. Policymakers are clearly acknowledging that inflation will remain elevated for an extended period, and they are intent on gradually raising rates to combat inflated prices. While interest rate hikes are on the horizon for 2022 and into 2023, it does not mean that equities will perform poorly. In fact, over previous rate hiking cycles, equities markets have performed quite well. (See the chart below from FactSet and Edward Jones showing previous rate hike cycles and returns of the S&P 500 Index.)

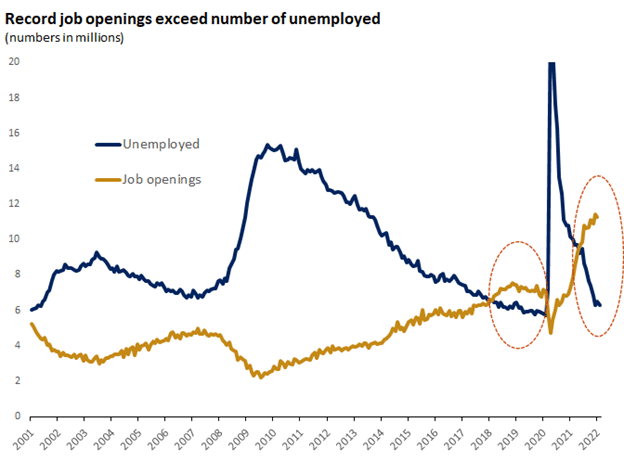

When you review the fundamentals of the U.S. economy and by extension the equity markets, the foundation for strength in both continues. In fact, most major components of the economy: housing, bank health, corporate strength, consumer health and labor remain solid. Chairman Powell pointed to the extraordinarily strong economy and tight labor conditions as additional reasons why they were raising rates at this time. Pointedly, unemployment is at a near record low 3.8%, while job openings continue to exceed the number of unemployed leaving a very tight labor market as a result. (See the chart below from FactSet showing the gap between job openings and the unemployed). The widening gap shown is evidence of tight labor conditions.

It is difficult, if not impossible, to project market returns weeks ahead, let alone months and years. The geopolitical concerns remain economic headwinds specifically the Russia / Ukraine war and price pressures in critical commodities like oil and rare earth metals and, as we have mentioned multiple times, markets hate uncertainty. The road ahead will be choppy and uncertain, and the Fed is attempting the oft impossible “economic soft-landing” of raising interest rates to stifle inflation, but not bringing the economy to a halt. As witnessed by last week’s stellar rally in equity markets, hiding on the sidelines is not a winning strategy.