by William Henderson, Chief Investment Officer

There was considerable volatility in the stock market last week, much like we have seen thus far in all of 2022. However, each major market index managed to chalk up a gain for the week. The Dow Jones Industrial Average posted a meager +0.3%, the S&P 500 Index rose +1.8% and the NASDAQ moved higher by +2.0%. Trends are always risky to call here, but that gives us two weeks in a row of positive returns on the markets and certainly a little bit closer to positive returns for the year. Year-to-date, the Dow Jones Industrial Average is down -3.6%, the S&P 500 Index is down -4.4% and the NASDAQ, which represents growth stocks is down -9.3% in 2022. While stock market returns were positive, the bond market handed investors a bad week with the 10-Year U.S. Treasury rising 34 basis points to 2.48% from 2.14% the week before, the highest level since September 2019. Bond yields are reflecting two key points in the markets: 1) The Fed’s new tightening regime, which began when the FOMC (Federal Open Market Committee) raised interest rates by 25 basis points and further pointedly stated up to six more rate hikes will follow; and 2) Persistent inflation that is running at 40-year highs.

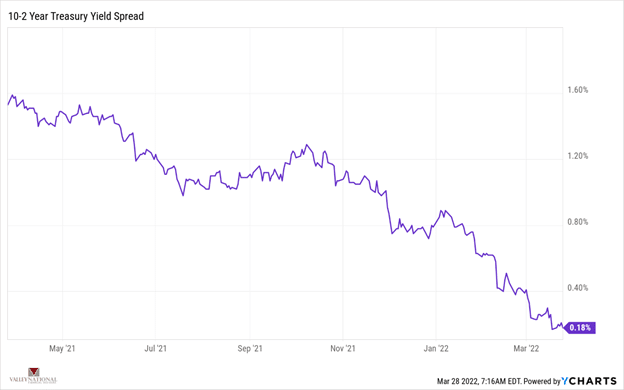

During the press conference after the FOMC announcement about the rate hike, Fed Chairman Jay Powell was certainly bullish on the economy, stating clearly, “the American economy is very strong and well positioned to handle tighter monetary policy.” The Fed is using their toolkit to quell runaway inflation with the expectation that higher short-term rates will not slow the economy. Shorter-term bond yields are already reflecting a lot of the expected Fed tightening yet to come. Two-Year U.S. Treasury yields are up 75 basis points in March and have risen 162 basis point in 2022 to 2.35% currently. Economists like to measure the so called “10s-2s spread,” meaning the spread in yield between 10-Year rates and 2-Year rates. Often, but not always, this measure has been used to predict a slowdown in the economy. (See the chart below from Valley National Financial Advisors and YCharts showing 10s-2s spread over the past year.)

While not yet negative, the spread has come down drastically over the past year and is now nearly flat – meaning you get extraordinarily little additional yield when buying a 10-Year U.S. Treasury (2.48%) compared to a 2-Year U.S Treasury (2.35%). This curve has flattened a lot this year reflecting the tighter monetary policy of the Fed and softer economic growth expectations for 2022 and 2023. This move in rates is in sharp contrast with Chairman Powell’s comments around strong expectations of U.S. economic growth and could simply be that the 2-Year U.S. Treasury has already priced in most future rate hikes.

It is important to understand that while interest rates are rising, they are not yet restrictive. Borrowing rates such as bank loans and mortgage rates remain low, offering borrowers attractive levels when expanding businesses or buying houses, confirming there is sufficient strength for consumers and businesses to absorb higher rates. Certainly, the strength of the labor market alone gives us confidence in the economy. Job openings remain high, unemployment remains at record lows and consumer confidence while falling a bit is still solid, especially given the $2 trillion in excess accumulated savings behind American households. Finally, we have pointed out here previously that stock markets have shown positive performance in 11 of the 12 previous rate hike cycles; again, showing that rising interest rates, especially from all time low levels, do not spell disaster for the economy.

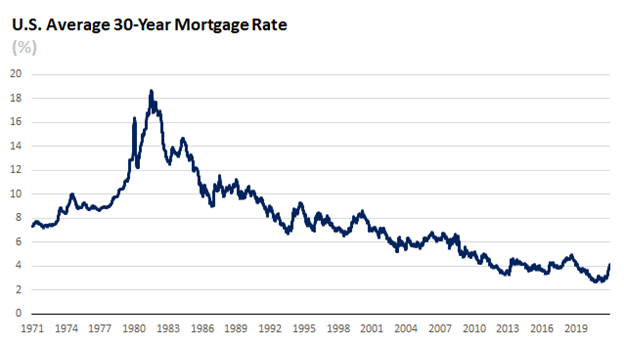

As mentioned above, mortgage rates are increasing along with all interest rates but, by historical measures, mortgage rates remain low and still offer future and existing homeowners attractive borrowing levels. (See the chart below from FactSet showing 30-year mortgage rates over the past 50 years).

Higher mortgage rates will not completely cool the hot housing market, but they could quell the strong increases in home prices we have seen over the couple of years. This act alone will help cool overall inflation levels and assist the Fed in that goal. Housing continues to be a strong component of the economy and leading housing indicators such as new home sale surveys and building permits remain elevated.

We remain cautiously optimistic on the stock market and the economy, for the reasons suggested above. The Russia/Ukraine war drags on with little mention of real cessation of aggression by Russia. The war continues to impact the energy markets specifically supplies of natural gas and oil to European Union regions, and some odd commodities such as palladium. Overall, the markets are dragging on and anticipating the end. There is sufficient expected growth in corporate earnings in 2022, which alone will be a source of decent returns in the equity markets. Lastly, bonds in 2022 have performed poorly, but now with the 10-Year Treasury bond yield nearing 2.50%, perhaps the yield alone is attractive to investors. Certainly, bonds always offer portfolios protection during times drastic market uncertainty and volatility, specifically geopolitical risks and economic anxiety.