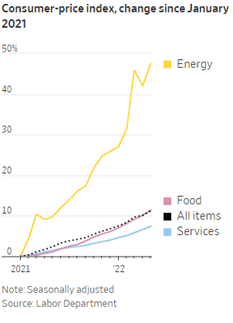

by Jonathan Susser, Investment Technology Associate

Little seems to be changing week-to-week in terms of consumer sentiment and the markets—that is that both are hitting recent lows. Russia’s invasion of Ukraine rages on, inflation hits a multiple decade high, and COVID remains a concern in China due to city-wide quarantines and lockdowns. Despite all of these apparent headwinds, history tells us that markets, even violently turbulent ones, recovery and investors are best suited with proper planning and commitment to long-term strategies.

Global Economy

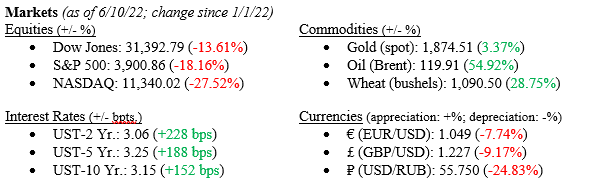

The average price of a gallon of gasoline in the USA broke the $5 per gallon threshold on Friday for the first time, contributing to high inflation across various industries, including food and other necessities. Chart 1 below illustrates the average price of gasoline on a state-by-state basis.

Chart 1: State Gas Price Average

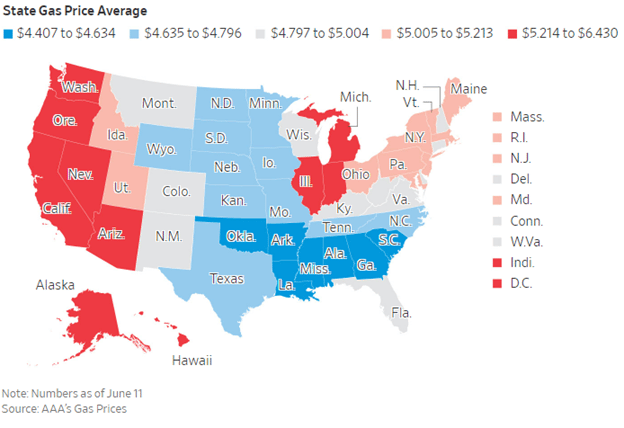

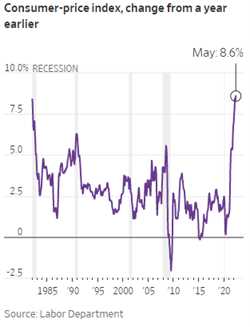

U.S. inflation numbers hit 8.6% on an annualized basis in May, making the month’s rate the highest since December 1981. Charts 2 and 3 showcase both the year-over-year CPI changes as well as CPI changes across industries from this year alone.

Chart 2: Consumer Price Index, Change from a Year Earlier

Chart 3: Consumer Price Index, Change since January 2021

Policy and Politics

The leaders of several European Union members will be meeting with President Zelensky later this week in order to discuss recent Russian gains in Ukraine. Zelensky has requested additional weapons and arms from Western countries to help combat Russia’s invasion attempt.

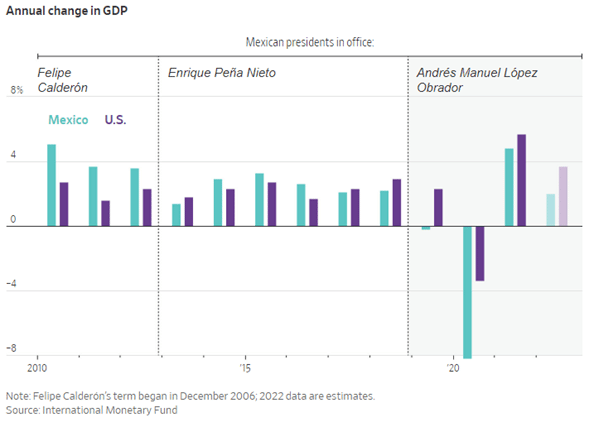

Mexican president Andrés Manuel López is attempting to nationalize several foreign-owned private companies’ energy assets, such as a fuel import terminal owned by KKR & Co and an 1,100-megawatt power plant owned by Iberdola SA. López is hoping to shift to a “Mexico-first” policy path focused on the domestic producers of natural resources. Chart 4 shows the annual change in Mexico’s GDP vs the U.S. under several presidents’ tenures.

Chart 4: Mexican GDP Growth versus the U.S.

What to Watch

- Month-over-month U.S. business inventories to be released on 6/15/22 at 10:00am EST.

- U.S. Building Permits data to be released on 6/16/22 at 8:30am EST.

- U.S. Housing Starts will be announced on 6/16/22 at 8:30am EST.