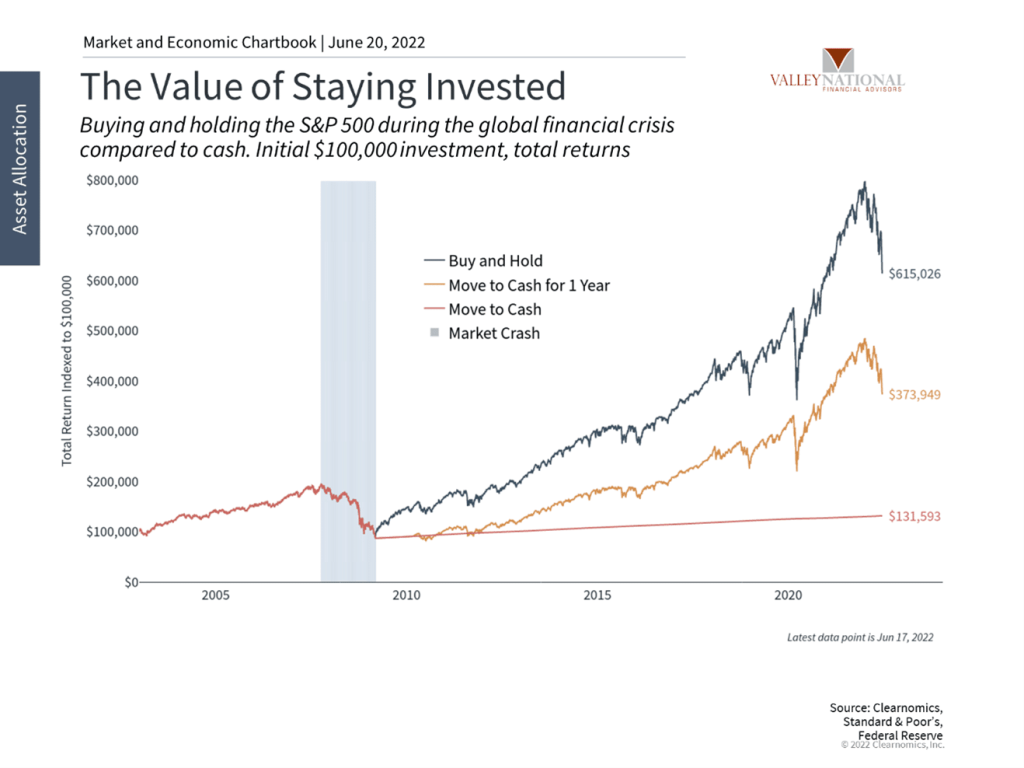

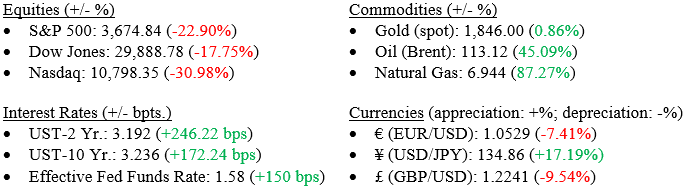

The hope for some immediate relief to investors faded as on as the markets faced their worst week since March 2020, with the S&P entering bear market territory early in the week. Consumers are not in a much better situation, as inflation lingers on the budgets of Americans everywhere and the summer saga of travel-related increased gasoline consumption will be met with rising energy prices. Regardless of the current market and economic environment, we must remember the value of staying invested and opportunities presented during periods of turmoil.

Markets (as of 6/19/22; change since 1/1/22)

Global Economy

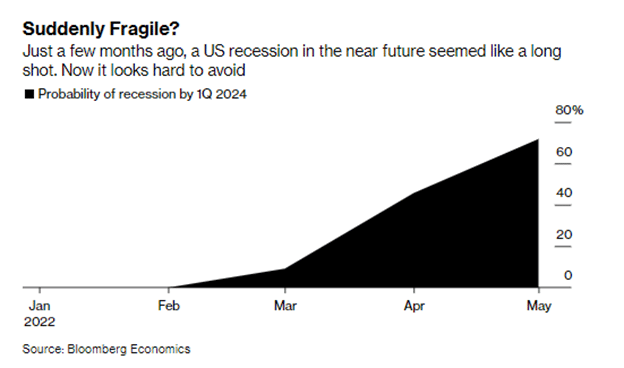

Treasury Secretary Janet Yellen provides little relief on the inflation front, stating that high prices are expected to continue rising for the remainder of the year, coupled with a prediction of slowed economic growth. Chart 1 depicts the probability of a U.S. recession.

Chart 1: Probability of U.S. Recession

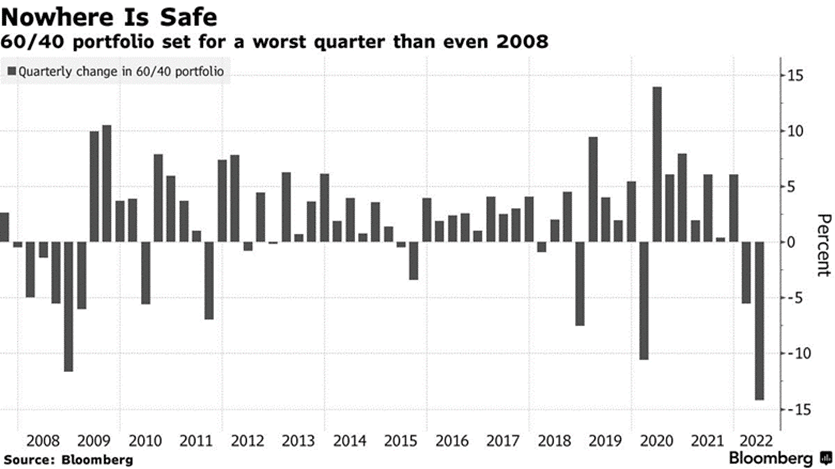

The tried and true “balanced” portfolio allocation model (60% stocks and 40% bonds) is set to endure a worse quarter than any during the bear market of 2008 (Chart 2). Unlike the era of the Global Financial Crisis, bonds are offering little relief to the sharp pains of the equities markets. The top 1% of wealth in the U.S. lost over $1.5 trillion this quarter, as they own more than half of all equities held in America.

Chart 2: Quarterly Change in 60/40 Portfolio

Policy and Politics

- Concerns are growing over the international status of the Taiwan Strait, as the Biden Administration interprets the assertive language used by Chinese officials in Beijing to describe the nautical powerhouse.

- Colombia has followed in the footsteps of previous Latin American countries before them and elected their first radical leftist, President Gustavo Petro, in a close race with his corporate-centered opponent Rodolfo Hernandez. Investor concerns around the situation are growing as Petro’s plans include phasing out oil production/consumption, tax increases on the wealthy, and creating a stronger bond with its neighbor, Venezuela.

What to Watch

- Fed Chair Jerome Powell’s semi-annual Congressional testimony begins on 6/22/22 at 9:30am EST and continues 6/23/22 at 10:00am EST.

- Initial Jobless and Continuous Claims report will be released on 6/23/22 at 8:30am EST.

- The final Michigan Consumer Sentiment report will be released on 6/24/22 at 10:00am EST.

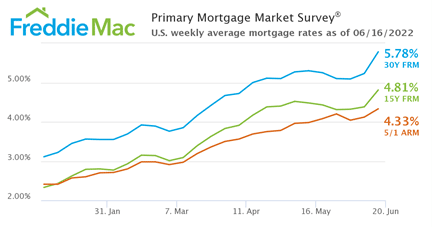

Chart 3: Primary Mortgage Market Survey