Little is changing week-to-week regarding inflationary and recessionary outlooks. Pricing levels across many commodities have softened, slightly easing inflation concerns. The Russo-Ukraine war continues to carry on as Russia begins to use its agricultural power as leverage in negotiations and sanctions. China continues its Zero-COVID policy with city-wide lockdowns, quarantines, and testing. Remember, times like these pose significant opportunity for long-term investors regardless of short-term tumult.

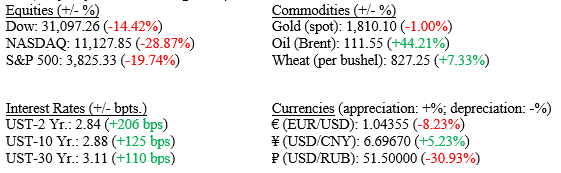

Markets (as of July 1st, 2022; change YTD)

Global Economy

Due to lockdowns across China, economists expect the country to fail to meet its 5.5% GDP growth goal. There is, however, a potential silver lining to this: slowed global inflation.

Russia’s control over agricultural exports is being utilized as leverage towards easing sanctions and in cease-fire negotiations.

Policy and Politics

The Biden administration is blocking new oil-drilling permits within the Atlantic and Pacific, while also allowing for very limited permits in the Gulf of Mexico and Alaska in an attempt to reduce reliance on foreign oil. Jeff Bezos also criticized White House pressures for gas stations to lower prices, calling it a “misdirection” and “deep misunderstanding” of market forces.

The Biden administration is considering a move to lower mortgage rates for first-time home buyers in lower income brackets as the median home price in the US ticks over $400,000 for the first time. However, experts are weary of these plans as they don’t “meaningfully address the supply-side problem.”

What to Watch

- US retail gas price figures to be released at 4:30PM EST on July 5th. Prior figure was $4.979/gal.

- ADP Nonfarm Payroll month-over-month figures to be released at 8:15AM EST on July 7th.