Despite catastrophic headlines globally such as the assassination of former Japanese Prime Minister Shinzo Abe, and the continued war ravaging Ukraine, the main market influencing issue is the seemingly unstoppable inflationary pressures worldwide. Further, China is again attempting to solidify its military grasp on Hong Kong. Regardless of these negative headwinds, the markets turned in a decisively positive week with the Dow Jones Industrial Average returning +1.8%, the S&P 500 Index notching +3.0% for the week and the NASDAQ returning a healthy +5.5% last week.

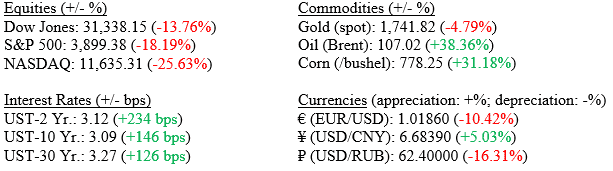

Markets (as of 7/8/2022; change YTD)

Global Economy

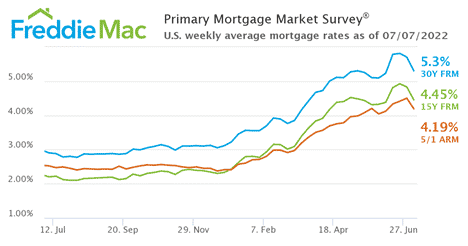

30-year fixed mortgage rates in the U.S. dropped for the second week in a row, from 5.70% to 5.30%. This is the largest weekly decline since the Global Financial Crisis, when rates fell from 5.97% to 5.53% in December 2008. Chart 1 shows mortgage rates over the prior year. This decrease reflects widespread recessionary fears and an obvious slowing in the housing sector.

Chart 1: Average rate on a 30-year fixed mortgage

Chinese annual inflation numbers surprised to the upside in June with China’s National Bureau of Statistics claiming that consumer prices rose by 2.5%, up from 2.1% in May and higher than the expected 2.4%. Production prices remained lower with 6.1% inflation, down from 6.4% in May and down from the recent high of 13.5% recorded in October 2021.

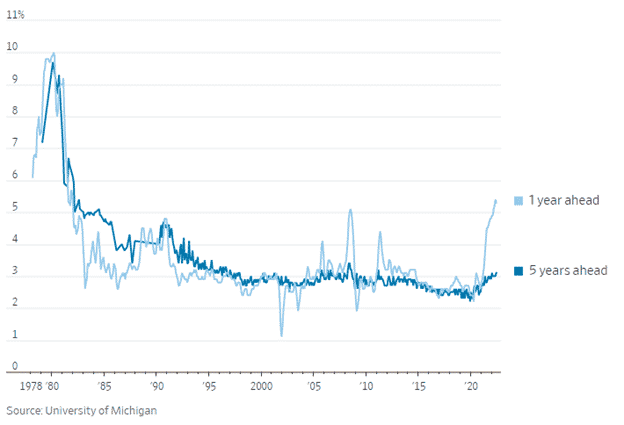

Last week, Federal Reserve Chair Jerome Powell acknowledged that the recent 75 basis point rate hikes increase the chances of an economic downturn in the foreseeable future. The stated idea behind this is to prevent a shift in consumer psychology that inflation will persist, which would create an inflationary feedback loop. Chart 2 shows consumers’ inflation expectations over the next one and five years; with the salient point being that consumers do not believe inflation to be long-lasting, at this point in the economic cycle.

Chart 2: Consumers’ inflation expectations

Policy and Politics

As Congress reconvenes in Washington this week, several items are on the agenda, including the potential codification of abortion rights into federal law, the onshoring of semiconductor manufacturers to the U.S. as part of the China bill, lowering prescription drug prices, and potentially raising taxes on corporations and high-income households.

What to Watch

- Both month-over-month and year-over-year U.S. Consumer Price Index data will be announced at 8:30AM EST on 7/13.

- U.S. Inflation Rate data will be announced at 8:30AM EST on 7/13.

- Both month-over-month and year-over-year U.S. Producer Price Index data will be announced at 8:30AM EST on 7/13