Earlier negative data on inflation (U.S. Consumer Price Index) for June 2022 +9.1% Year Over Year rocked the equity markets and pushed investors to the relative safety of U.S. Treasury bonds. However, by the end of the week, two new pieces of inflation data (Empire State Manufacturing Prices Paid and Consumer Inflation Expectations) both moved sharply lower indicating that inflation may have peaked, and the markets snapped back nicely on Friday, although not enough to end the week in positive territory. For the week, the Dow Jones Industrial Average fell –0.16%, the S&P 500 Index lost –0.93% and the NASDAQ fell –1.57%. We take a deep dive look at inflation below. The 10-Year U.S. Treasury Bond fell 16 basis points last week to close the week at 2.93% giving back investors 1.00% of return on the year.

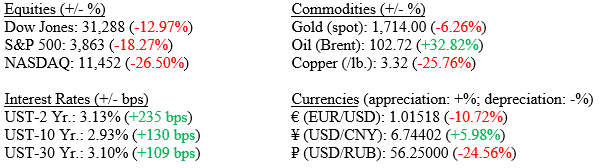

Markets (as of 7/15/2022; change YTD)

Global Economy

President Biden’s trip to the Middle East will not be impacting oil prices anytime soon as he was unable to secure any reasonable increase in oil production from Saudi Arabia. A look at Chart 1 (from Haverford Trust and JP Morgan) shows Contributors to Headline Inflation since March 2021. Note: energy and shelter (housing) continue to be the largest contributors. Both can be easily impacted by prevailing market trends and quickly as is evidenced by gasoline prices retreating from recent highs.

Chart 1: Contributors to Headline Inflation

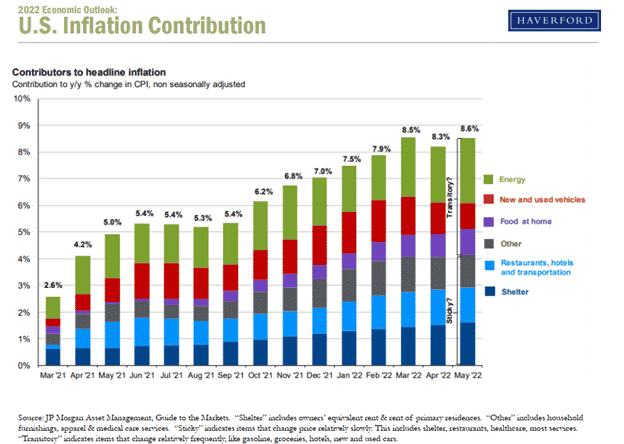

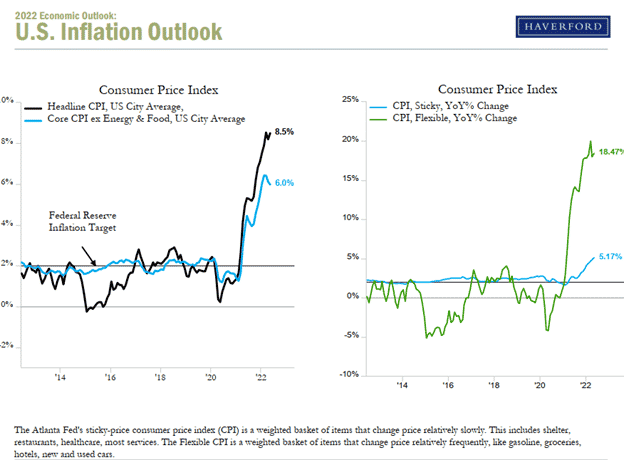

As noted above, we want to do a deeper dive into inflation data hitting the wires. Inflation can be broken down into “sticky” vs “flexible.” See Chart 2 below (from Haverford Trust and the Atlanta Fed) showing CPI broken into Sticky (shelter, healthcare, restaurants) and Flexible (energy, groceries, cars) components. What is important is that the larger share of the current inflation spike is flexible; and therefore, can come down quickly (again evidenced by the recent drop in gasoline prices. Further, see Chart 3 (from Haverford Trust) showing Major Commodity Prices and how they all are down dramatically from their recent highs.

Chart 2: Consumer Price Index (Sticky Inflation vs Flexible Inflation)

Chart 3: Major Commodities Prices

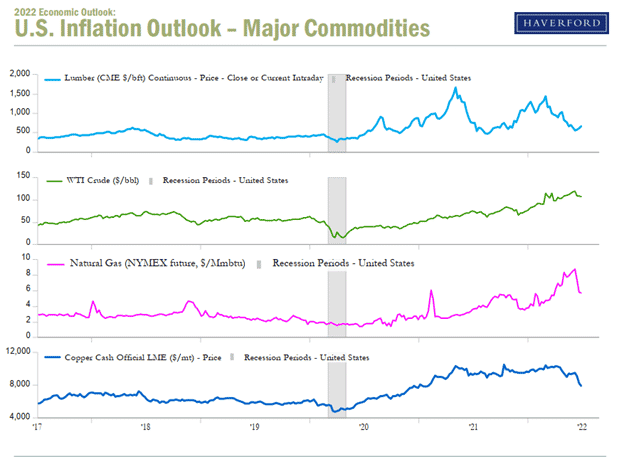

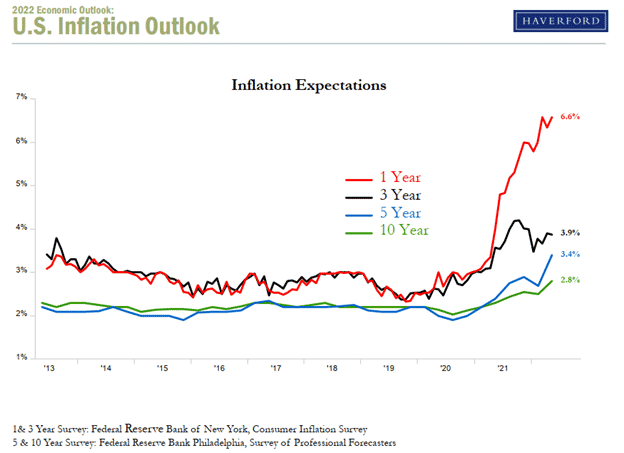

Lastly, as we mentioned last week, expectations for future inflation are drastically different than current inflation trends. Importantly, consumers and the markets are not pricing in continued hot inflation data beyond one year hence. See Chart 4 below (from Philly Fed, NY Fed, & Haverford Trust) showing the 1, 3, 5, and 10-Year Consumer Inflation Expectations. As the markets, consumers and Fed Chairman Jay Powell digest this predictive inflation data, we could see some stabilization in the markets. Watch for earnings releases and employment data as each of these could show where potential weaknesses exist.

Chart 4: 1, 3, 5 and 10-Year Consumer Inflation Expectations

Policy and Politics

The Federal Reserve is preparing to raise rates by another 75bps later this month to combat inflation, although a 100bps move is also on the table.

Senator Manchin struck down the Global Minimum Tax proposal, which would require a 15% tax on multinational corporations around the world.

What to Watch

- U.S. Retail Gas Price data will be released at 4:30PM ET on July 18th.

- U.S. Housing Starts data will be announced at 8:30AM ET on July 19th.

- 30 Year Mortgage Rate data will be released at 10:00AM ET on July 21st.