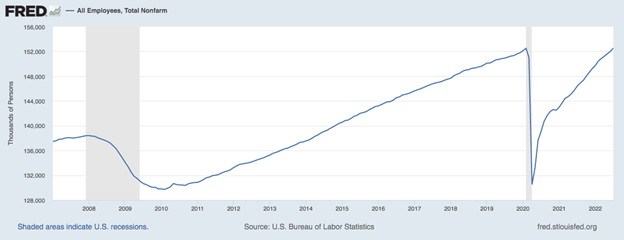

Major equity markets finished mixed last week with the Dow Jones Industrial Average falling by a modest -0.13%, the S&P 500 Index increasing +0.36% and the NASDAQ finishing the week up a healthy +2.15%. Markets were compelled higher on an extraordinarily strong July 2022 new jobs numbers +528,000 and a near record low unemployment level of 3.5%. This new employment data means the economy has gained back all the jobs lost since the COVID-19 pandemic began in March of 2020.

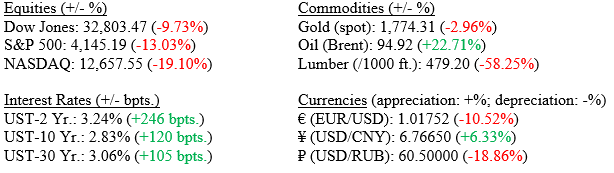

Markets (as of EOD 08/05/2022; change YTD)

Global Economy

U.S. Treasury bonds sold off last week on Friday’s stronger-than-expected jobs report. Investors sold bonds on the news and the yield of the 10-Year U.S. Treasury bond increased to 2.83% from 2.67% last week. What is more important to watch is the continued steeply inverted yield curve (Chart 1) we are witnessing with the 2-Year U.S. Treasury yielding 3.24% vs the 10-Year U.S. Treasury at 2.84%. We have mentioned it many times that inverted yield curves (when shorter-term bonds yield more than longer-term bonds) typically precede recessions.

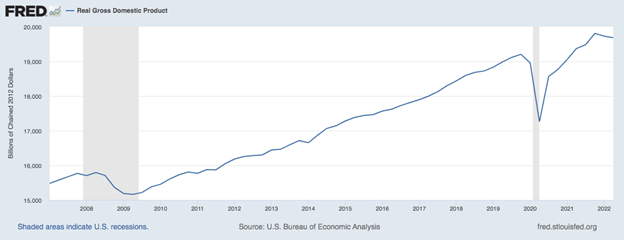

Since the curve first inverted earlier in 2022, we have since seen two quarters of negative GDP (Gross Domestic Product): 1Q -1.6% and 2Q -0.9%; which historically has defined a recession (Chart 2).

Herein lies the conflicting data the Fed and economists need to deal with. We have massive new job growth (Chart 3) strong EPS (Earnings Per Share) and healthy U.S. banks, so it is difficult to admit we are in a recession.

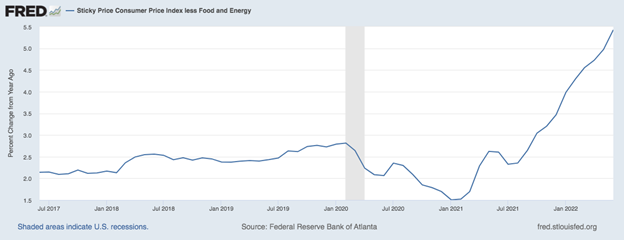

However, continued hot inflation data (Chart 4) is compelling the FOMC (Federal Open Markets Committee) to raise rates aggressively, which is slowing the economy, as shown in Chart 2 above.

Our summary here is that the markets are telling us something different than the economic data. Since the 10-Year U.S. Treasury bond hit its recent high on June 14, 2022, of 3.48%, the S&P 500 Index is up 11%. Whether this signaled the end of the bear market or not is yet to be seen. However, the stock market has historically been the best predictor of future economic growth. We are giving credit to Chairman Powell and hoping that he can achieve a path to a soft landing from extremely high inflation to modest inflation (~2.5%) and solid employment (unemployment ~ 3.5%).

What to Watch

- U.S. Retail Gas Price for the week of August 8, 2022, released at 4:30 p.m. on August 8th.

- U.S. Consumer Price Index, Year-over-Year for July 2022 released at 8:30 a.m. on August 10th

- U.S. Inflation Rate for July 2022 released at 8:30 a.m. on August 10th

- U.S. Producer Price Index, Year-over-Year for July 2022 released at 8:3 a.m. on August 11th

- 30-Year Mortgage Rate for the week of August 11, 2022, released at 10:00 a.m. on August 11th