Quick Market Update-Pay attention to the little things!

Housing Market? Ask the Investment Professional

Ask the Investment Professional

Its the big picture that matters!

Don’t Worry too much about sticky inflation!

Ignore the Noise and Stay Focused on the Long-term trends with our CIO, William Henderson.

Get to know our new Director of Research & Investments

Quick Market Update with our CIO William Henderson 3/6/2024

Quick Market Update with CIO William Henderson

Market Update with our CIO William Henderson

There's no stopping the U.S. Consumer

Message from the CEO: Thank you!

Market Update Minutes Following the Fed Announcement

VNFA Team Chat – Trending Topics (February 2021)

VNFA Team Chat – Trending Topics (February 2021)

VNFA Team Chat –2021 Outlook

VNFA Team Chat – Trending Topics (December 2020 – PART II)

VNFA Team Chat – Trending Topics (December 2020 – PART I)

Message from the CEO: Thank you!

Team Chat – Trending Topics (November 2020)

Team Chat – Trending Topics (October 2020)

Q3 2020 Market Commentary

Retirement Planning Checklist

Tax FAQ - update on 2019 filings and 2020 planning

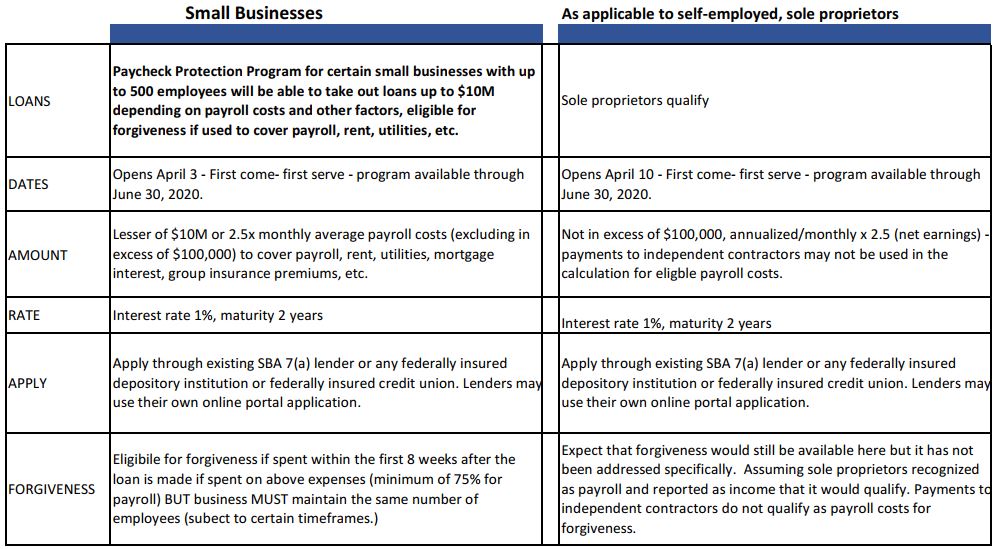

Options in Financial Planning Due to COVID 19

Message from the CEO - May 5, 2020

Q1 2020 Market Commentary

Message from the CEO - March 20, 2020

Health Savings and Flexible Spending Accounts

Q4 2019 Market Commentary

Message from the CEO: Our 35th Anniversary

Q3 2019 Market Commentary

Capital Gains/Losses & Dividends

Required Minimum Distributions

2019 Year-End Tax Planning Topics

Tax-Savvy Charitable Giving

Pension Decisions: Lump Sum vs Payment Plan

The Value of a Diverse Portfolio

Executive Compensation Series - Stock Concentration

Executive Compensation Series - Stock Options

Message from the CEO: Financial Times Top 300

Q2 2019 Market Commentary

Executive Compensation Series - Restricted Stock

Executive Compensation Series - Deferred Compensation

Investing: The Value of a Long-Term Approach

Executive Compensation Series - Introduction

VNFA's 10th Anniversary Volunteer Challenge Project

529 Plans: PA State Tax Benefits

Q1 2019 Market Commentary

Message from the CEO - April 2019

Estate Planning Series - Executing the Plan

Estate Planning Series - Understanding Taxes

Estate Planning Series - Considering Heirs

Estate Planning Series - Asset Inventory

Estate Planning Series - Identifying Goals

Estate Planning Series Introduction

2018 Year-End Tax Planning

Q3 2018 Market Commentary

What Is a Trusted Contact Person?

Relationships. Communication. Direction.

Valley National Financial Advisors: Our Story