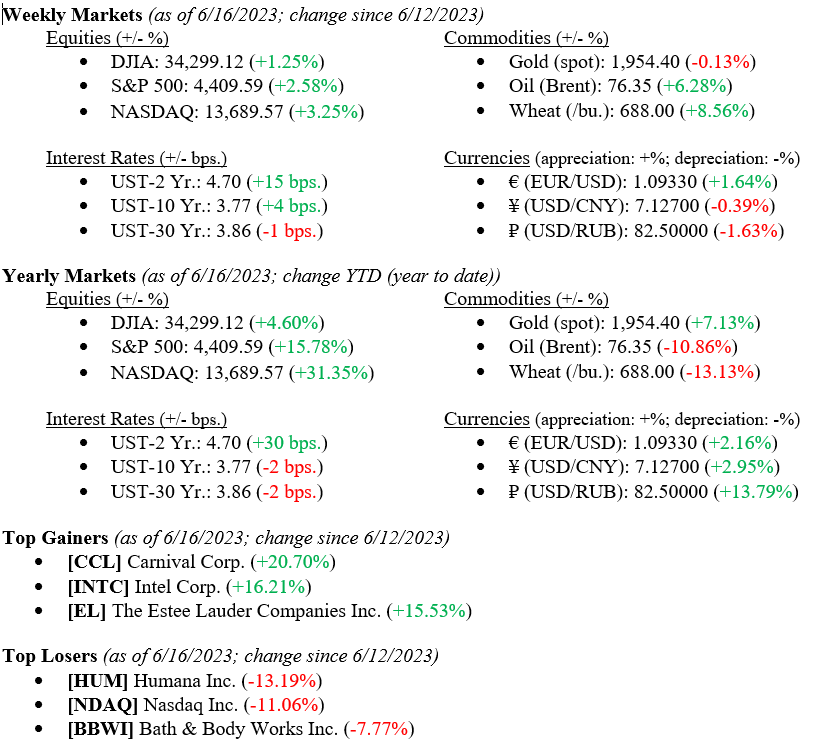

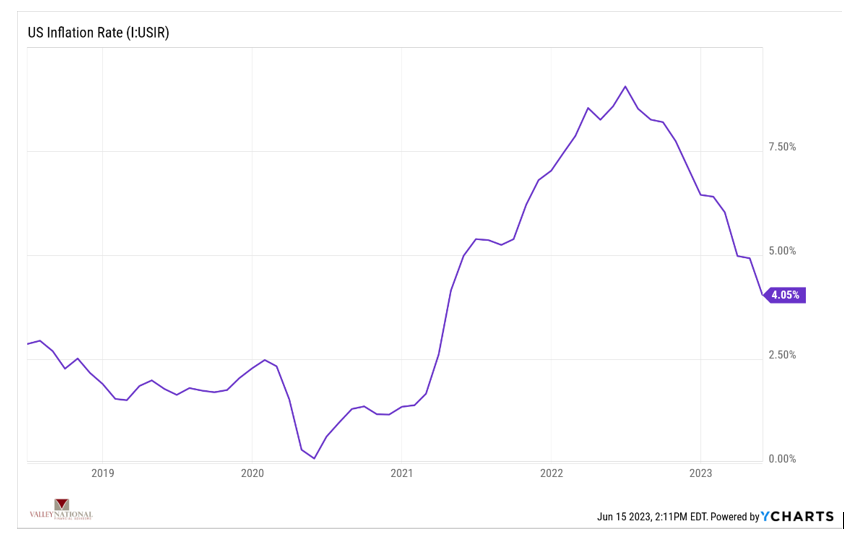

Equity markets posted a strong week with all three major indexes returning healthy positive numbers, and the NASDAQ led the way with a +3.3% return for the week, followed by the S&P 500 Index posting +2.6% and finally, the Dow Jones Industrial Average notching a +1.3% return. Year-to-date, market averages remain well into positive territory, with the Dow Jones at +4.6%, the S&P 500 at + 15.8%, and the NASDAQ at +31.4%. This week we saw inflation data, both Core PCE (Personal Consumption Expenditures) and Core CPI (Consumer Price Index), fall (see charts below), proving that the Fed’s year-long plan of taming inflation via higher interest rates is working. This week also saw the results of the two-day FOMC (Federal Open Market Committee) meeting, where policymakers decided to take a pause on further interest rate hikes. That said, at his press conference after the meeting, Chairman Jay Powell clearly and succinctly stated that further rate hikes in 2023 could be on the table, and any further policy would be data dependent. The markets initially shrugged on this news, but weaker inflation data and a strong U.S. economy led the way by week’s end, pushing the market higher. The 10-year U.S. treasury closed the week at 3.76%, five basis points lower.

The Consumer Price Index rose 0.1% in May on a seasonally adjusted basis, a decrease from the 0.4% rise we saw in April. Year-over-year, inflation clocked in at 4.0%. This was largely in line with expectations. Energy as a category fell by 3.6% month-over-month, while food rose by 0.2%.

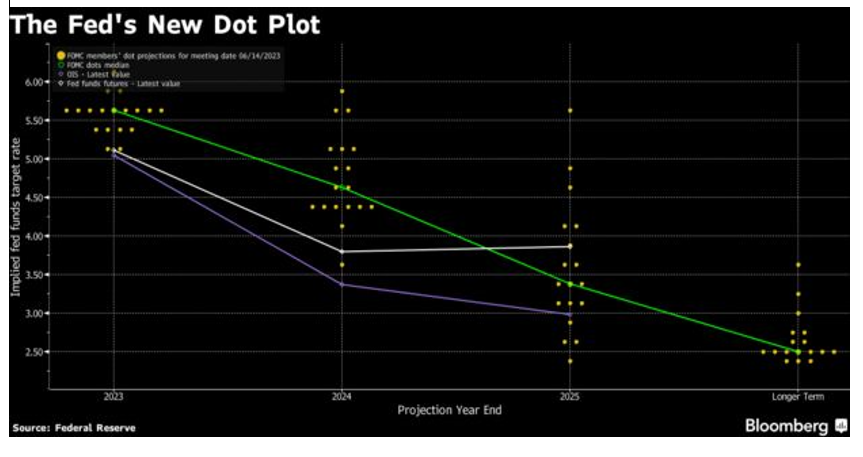

The U.S. Federal Reserve paused interest rate hikes for the first time in 15 months, leaving the target Fed Funds rate between 5.00% and 5.25%. This decision comes on the heels of the inflation data, signaling that the economy is slowing down enough to warrant a “wait-and-see” approach from the Fed, although they have indicated that two more rate hikes are both possible and likely. Fed forecasts indicated by the Dot Plot below show that rates are expected to rise above 5.6% by year-end, with 12 of the 18 policymakers putting them between 5.50% and 5.75%.

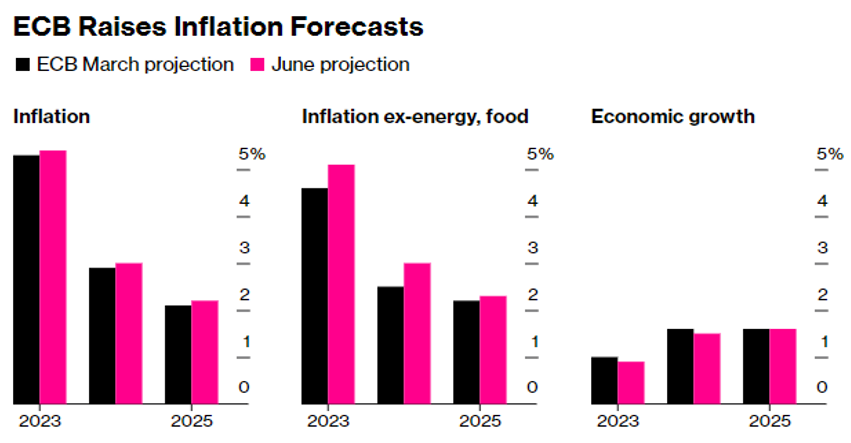

Across the pond, the European Central Bank continues their slow and steady approach to combating inflation. The ECB decided to raise rates by 25 basis points to 3.25%, saying that future hikes are “very likely.” Traders are implying a significant probability of rates in Europe increasing to 4% by October. This is due to projections suggesting that inflation will be tempered more slowly than previously thought, hitting 2.2% in 2025, which is still above the 2% target but down from the current rate of over 5%.

What to Watch

- Tuesday, June 20th

- U.S. Housing Starts at 8:30AM (Prior: 1.401M)

- U.S. Retail Gas Price at 4:30PM (Prior: $3.707/gal.)

- Wednesday, June 21st

- U.S. Job Openings: Total Nonfarm at 10:00AM (Prior: 10.10M)

- Thursday, June 22nd

- U.S. Existing Home Sales at 10:00AM (Prior: 4.28M)

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.69%)

We continue to remain cautiously optimistic about the markets and the economy. With the latter being our fundamental reason, we are positive on equity markets this year. Consumers remain resilient and have not yet dramatically cut their spending, lenders such as private credit funds have stepped in where banks have pulled back since the March mini-bank tremor, and U.S. corporations are still making money. We have no idea about Artificial Intelligence (AI) or its long-term impact on growth or development, but for decades investors have underpriced technology’s impact on efficiency, and we do not expect anything different this time around. As always, stay focused and watch for continued signs of strength or weakness and reach out to anyone at Valley National Financial Advisors for help.