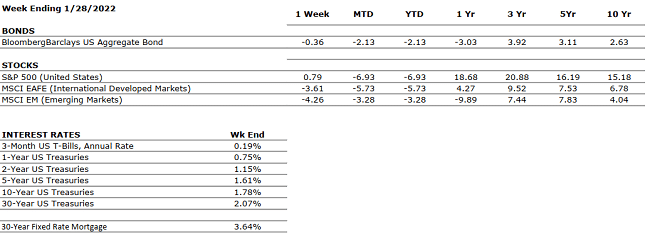

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. GDP growth decelerated to a 2% annualized pace in Q3. The slowdown was driven primarily by supply chain constraints. Economists expect a modest acceleration in Q4. Early high-frequency data (shopping, travel, movie ticket sales) is showing some slowing. Holiday retails sales numbers will be important to gauge consumer behavior. |

|

CORPORATE EARNINGS |

POSITIVE |

Fourth quarter wrapped up and earnings are likely to be impacted by labor, supply shortages, price increases and wage inflation. As EPS estimates are ironed out each of these items will play a role, some greater than others. Watch for increases but at a muted pace. |

|

EMPLOYMENT |

POSITIVE |

Although December increase in payrolls did not meet expectations (199,000 jobs added versus 422,000 expected), the unemployment rate fell to 3.9% versus an expected 4.1%. Wages increased more than expected at 4.7% year-over-year. Strong recovery in leisure and hospitality which had the biggest gain by industry and accounted for more than 25% of all jobs added in December (55,000). |

|

INFLATION |

NEGATIVE |

CPI rose 7% year-over-year in December 2021, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Will inflation be transitory or permanent? Goldman Sachs capital market assumption forecast CPI at an average of 3.1% for 2022 suggesting a significant decrease in inflation from the current 7%. |

|

FISCAL POLICY |

NEUTRAL |

The Build Back Better Bill has been scaled back from $2.2 trillion to a $1.8 trillion version as Senator Manchin continues to hold back support. President Biden has mentioned the idea of breaking up the BBB Bill into smaller pieces to be able to pass fractions of it. The economy seems to be digesting a new world where fiscal policy is no longer considered an economic stimulus. |

|

MONETARY POLICY |

NEUTRAL |

Fed discussed a triple threat of tightening: raise interest rates, halt purchases, and reduce its balance sheet (reducing holdings of Treasurys and mortgage-backed securities). Gradual and steady reduction of liquidity will be key in preserving market performance (fast and sudden changes would most likely result in panic-driven sell offs). Expect three rate hikes in 2022 beginning in March. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

The omicron COVID-19 variant has shown up in many parts of the world. This strain seems less virulent and more reactive to boosters so its impact it still yet to be calculated. A rebound in travel and leisure now seems unsure. Important to watch the Russia/Ukraine situation. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions are hampering the economy; however, demand remains very strong. While global logistics are operating far below normal efficacy, it appears the supply chain is slowly improving and may reach normalcy by mid-to-late-2022. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.