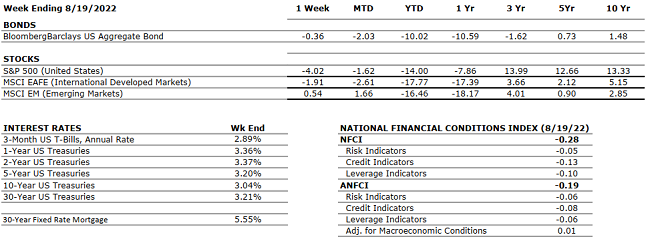

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.6% annual rate. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. According to the second estimate, real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q2 2022 was 6.7% (up from previous estimates of 4.3%) which marked a new post-pandemic low; but still solidly in the “growth” stage. Most companies have reported earnings for Q2 2022 and early indications of third-quarter earnings are expected to be released starting next week. |

|

EMPLOYMENT |

POSITIVE |

U.S. Nonfarm Payrolls for July 2022 increased by a stunning 528,000 new jobs compared to economist’s estimates of 250,000. The latest unemployment rate for July came in at 3.5%, nearing a record low. Employment activity and job growth continues to impress everyone while also confounding everyone as GDP is slowing at the same time. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the US increased by 8.5% for July 2022. The gasoline index fell 7.7% and the energy index fell 4.6% which offset the increases in food and shelter indexes. The PPI decreased 0.5% in July and registered a year-over-year gain of 9.8%. PCE (Personal Consumption Expenditures) fell to 6.28% in July vs 6.80% for June. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, EV cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. Last week, President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEUTRAL |

The current target for Fed Funds is a range of 2.25% to 2.5%. With inflation still running hot, Fed Chairman Jay Powell is clear on his path to slow the economy enough to cool inflation. This plan has been reiterated at the Jackson Hole symposium. The next Fed meeting is September 20-21 and markets are pricing in another 0.50-0.75% increase in short term rates. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia has defaulted on its debt as of late June for the first time since 1918. Sanctions imposed by Western powers effectively isolated Russia and its financial system from Europe and the U.S. making it much harder for Russia to complete international financial transactions. On a good note – Israel and Turkey have restored diplomatic ties and will be exchanging ambassadors again after four years. This should result in a significant improvement in regional stability. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian- Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. Starting in June, China has started to remove some restrictions in major cities to end the COVID-19 lockdown. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.